iowa capital gains tax rates

Consequently Iowa would tax the capital gain from a typical stock sale at a rate of 898 percent the rate that applies to an individuals. The law modifies Iowa Code.

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map

Do not subtract any Iowa capital gain deduction on this line.

. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state allows a deduction for federal income tax. Additional State Capital Gains Tax Information for Iowa Iowa allows taxpayers to deduct federal income taxes from their state taxable income. Iowa Capital Gains Tax.

The top rate will lower to 57 giving a tax cut to Iowans making 30000 or more. Iowa collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The new 2022 law significantly reduces future individual income tax rates beginning in 2023.

Iowas maximum marginal income tax rate is the 1st highest in the United States ranking directly below Iowas You can learn more about how the. The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form. A slight reduction in Iowa personal tax rates was signed into law in 2018.

Enter 100 of any capital gain or loss as reported on line 13 of your federal 1040. Kristine Tidgren director of Iowa States Center for Agricultural Law and Taxation said because of the proposed increase in rates we estimate that on average a full-time farmer owning 358 acres of farmland would see tax liability from a lifetime sale increase from 475248 to 860572 an 81 increase or from 145 to 26 of fair. The highest rate reaches 11.

It also reduces the number of tax brackets in 2023 through 2025 and implements a flat tax in 2026. State Tax Rate ex. This rate applies to income over 78435.

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains. Ad Compare Your 2022 Tax Bracket vs. Iowa Cigarette Tax.

Beginning in tax year 2023 implement four tax brackets ranging from 44 to 60. However the changes are relatively minor. Discover Helpful Information and Resources on Taxes From AARP.

The top rate will lower to 482 giving a tax cut to those making 6000 or more. The current statutes rules and regulations are legally controlling. Both long- and short-term capital gains are taxed at the full Iowa income tax rates depending on your income tax bracket.

When a landowner dies the basis is automatically reset to the current fair market value at the time of death. 51 rows The combined state and federal capital gains tax rate in Iowa would. CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including.

Cedar Rapids Des Moines Iowa City Davenport Ames Sioux City and Mason City. Capital GAINS Tax. For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction on qualifying capital gains as specified in a.

In subsequent tax years eliminate the top rate annually until a 39 flat tax rate is achieved in tax year 2026. Unlike the Federal Income Tax Iowas state income tax does not provide couples filing jointly with expanded income tax brackets. A Like-Kind Exchange with a conservation agency might help you protect land while deferring capital gains taxes.

Iowa taxes capital gains as income. In a nod to the states agricultural industry Iowa also has cutouts to its capital gains tax where family-owned business that have operated for a significant amount of time are. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two stiff tests.

Your 2021 Tax Bracket to See Whats Been Adjusted. Capital gains tax rates on most assets held for a year or less correspond to. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

The Combined Rate accounts for Federal State and Local tax rates on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent. Taxes capital gains as income and the rate reaches 853. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

Iowa income and capital gains tax rate. The potential change in 2023 may make Iowa more competitive with a max tax rate of just 65. Starting in 2023 Iowa Code 422721 would be amended to narrow this deduction to the net capital gain from the sale of real property used in a farming business if certain conditions are satisfied.

Excise taxes on alcohol in Iowa vary depending on the type of alcohol being sold. The 2018 tax reform legislation set the top individual tax rate for 2023 and beyond at 65 percent. You must complete the applicable IA 100 form to make a claim to the Iowa capital gain deduction on your return.

Should the Department request it the information on the Capital Gain Deduction Checklist will be needed to verify whether you qualify for the deduction. Iowa has a unique state tax break for a limited set of capital gains. Iowa has a cigarette tax of 136 per pack.

Individual income tax exclusion for capital gains narrowed. A 39 flat tax is projected to save Iowa taxpayers more than 167 billion by tax year 2026. Tax rates are the same for every filing status.

Toll Free 8773731031 Fax 8777797427. Current Iowa law has complex rules governing the deductibility of certain capital gains. The real estate has to have been held for ten years and.

So is there any way to find out what is the deduction rate for long-term vs short-term gains. Hawaii taxes capital gains at a lower rate than ordinary income. Moreover the deduction could not exceed 17500 for the tax year.

Even after the small reduction in personal tax rates Iowans will still be one of the highest taxed in the nation.

What Is Capital Gains Tax And When Are You Exempt Thestreet

How To Avoid Capital Gains Tax On Your Investments Investor Junkie

How To Pay 0 Capital Gains Taxes With A Six Figure Income

State By State Guide To Taxes On Retirees Kiplinger Retirement Advice Retirement Tax

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investing

Long Term Capital Gain Tax Rate For 2018 19 Capital Gain Capital Gains Tax What Is Capital

2021 Capital Gains Tax Rates By State

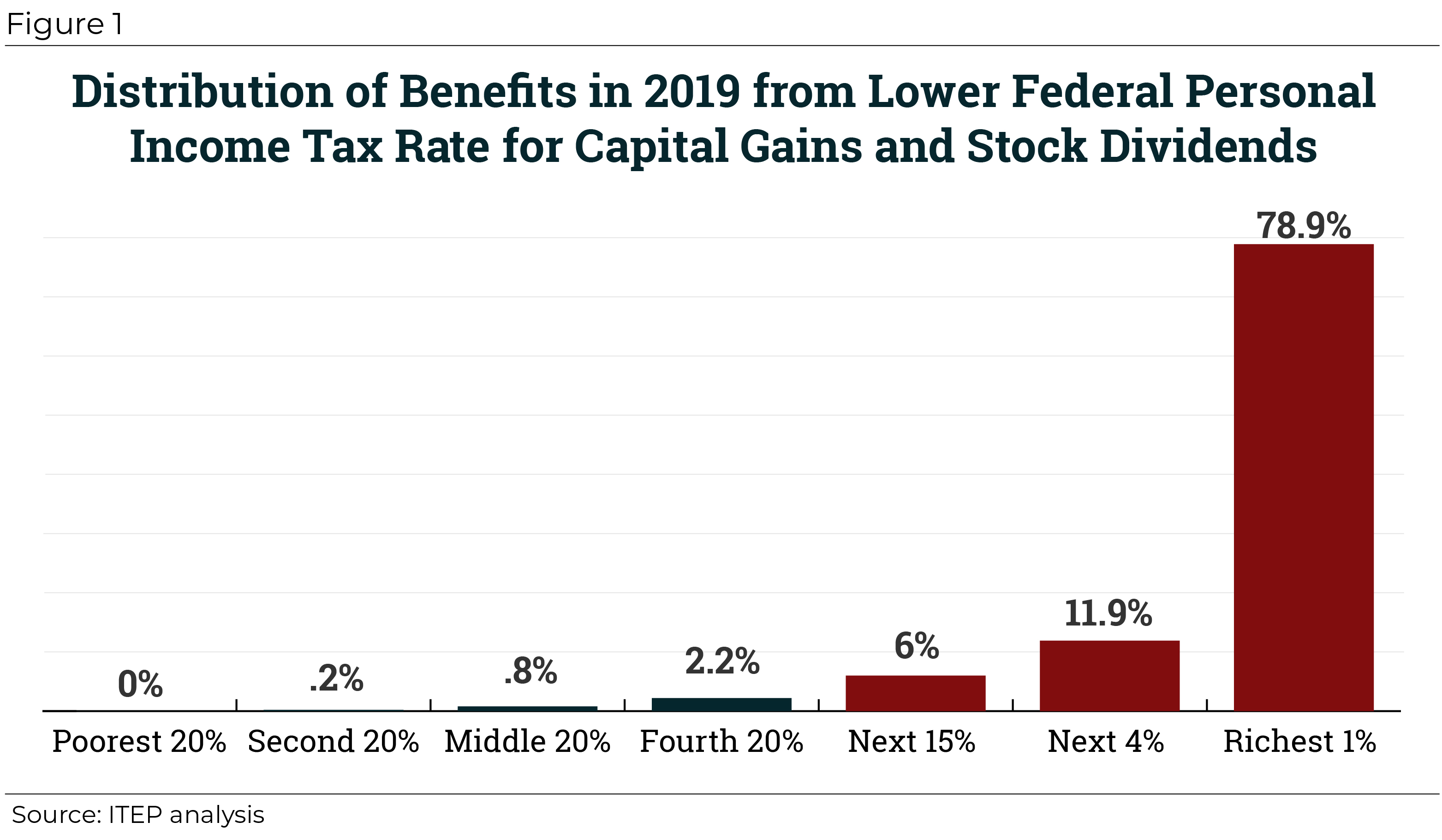

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

How High Are Capital Gains Taxes In Your State Tax Foundation

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isn T Everything

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax Calculator Real Estate 1031 Exchange Capital Gains Tax Capital Gain What Is Capital

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Capital Gains Tax Brackets For Home Sellers What S Your Rate Capital Gains Tax Capital Gain Tax Brackets